ONBOARDING

Personal Loan Application

Role: Product Designer

Company: SOFI

Year: 2018

The Challenge

A SoFi Personal Loan delivers credit instantly, to responsible borrowers, to use as a tool and not a burden. Previous design had outdated and cumbersome user experience. Conversion rates on mobile web lag desktop conversion rates across the funnel.

There is significant opportunity to improve Personal Loan applicant conversion rates by delivering an improved user experience.

Previous Experience

Had no clear indicators where users are dropping in the funnel. Application flow was dated and cumbersome to complete, especially on mobile. Reviewers tasks were completed largely manually, resulting in errors and slowing time to fund

SOLUTION

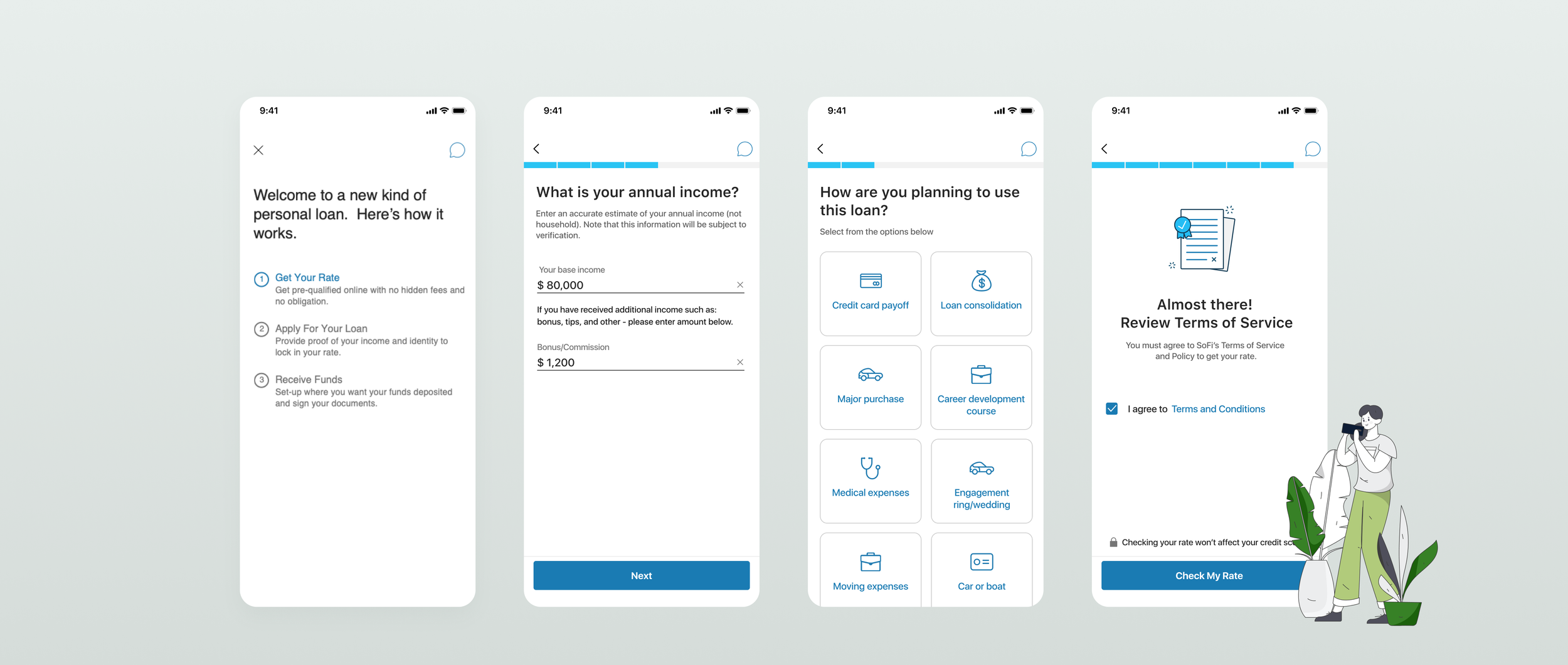

Conversational Onboarding

Redesign on-boarding for a Personal Loan product by providing step-by-step guidance to achieve a goal. Created a conversational technique that focuses on a few questions as opposed to multiple fields per page. Included some interactive elements to simplify process, set expectations, assist, secure, and celebrate accomplishments.

Pre Approval Flow

Decreased input fields from 25 to 9 input fields, simplified steps, and increased pre-fills to help reduce steps. Also increased speed by transitioning step drop downs into faster tap inputs.

Verification Flow

Implemented smart branching that only asks for relevant and necessary identity and income documents. Lead with recommendations for products based on inputs.

Responsive Web Layout

Flow focused on speed to rate and speed to apply, with simple bit sized questions. Progress bar indicators set expectations and reinforce progress. Lastly, implemented a live chat option to help and guide users with the application.

Outcome

This on-boarding experience led to increased retention and engagement by eliminating unnecessary questions or forms to understand the user's needs and personalized product suggestions.

30% relative lift in start to fund upon shipping Personal Loan 2.0. Through some optimizations post launch.

35% range - It also drove substantially more volume/revenue and materially lowered our cost per funded loan.